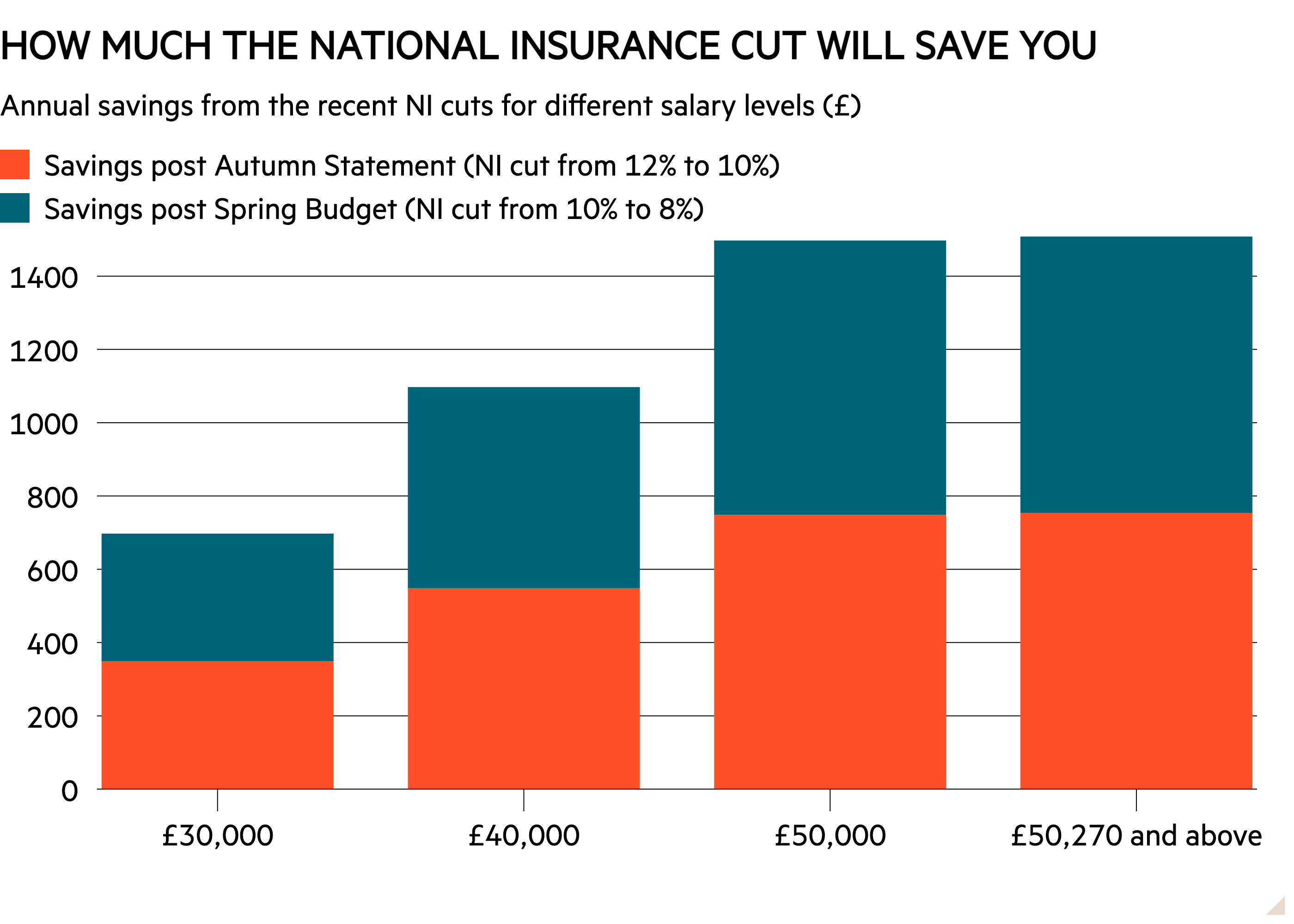

Chancellor Jeremy Hunt announced a further 2p cut to national insurance contributions, telling MPs that he wanted to help families with “permanent cuts in taxation” as part of his ‘Budget for long-term growth’.

This latest cut will reduce the employee national insurance rate by 2 percentage points, from 10 per cent to 8 per cent from April. Self-employed national insurance will also decrease by 2 percentage points from 8 per cent to 6 per cent. Hunt had already cut national insurance for both employees and self-employed in last year’s Autumn Statement which came into effect in January.

According to analysis from the Institute for Fiscal Studies think tank, a 2p national insurance cut will not be enough to prevent taxes rising to a record share of GDP by 2028/29. Despite delivering a minimal bounce in the polls after the Autumn Statement, national insurance cuts have the advantage of being both less inflationary and cheaper than income tax cuts.

Income tax cuts benefit both workers and pensioners, and carry a greater cost of around £7bn for each 1p cut, against £5bn for national insurance. HT and VC

Better inflation forecasts but Hunt restricted

This Spring Budget provided a vital opportunity for the government to impact the economy before the upcoming election, but the chancellor was constrained by limited ‘headroom’ against his borrowing rules. Forecasts from the Office for Budget Responsibility (OBR) lowered projections for UK inflation and suggested a subdued outlook for growth, which will reduce expected tax revenues over the period.

The watchdog now expects inflation to fall below 2 per cent in a matter of months – a year earlier than forecast at the time of the Autumn Statement. The OBR expects growth to rise to 0.8 per cent in 2024, against its previous forecast of 0.7 per cent. Nevertheless, headroom of £8.9bn was close to record lows, and far smaller than the recent average of almost £30bn that chancellors have enjoyed.

Hunt has stressed his desire to move to a lower tax economy but told MPs today that the government must be fiscally responsible and increase its resilience to future economic shocks.

Read more: Chancellor games his own rules

British Isa launched to bolster domestic stocks

Investors will have a dedicated tax-free individual savings account (Isa) allowance for UK shares, under plans announced in today’s Spring Budget by chancellor Jeremy Hunt. The measure is meant to entice investors to allocate more to UK stocks.

Investors will have a tax-free annual Isa allowance of £5,000 to invest in UK equities, on top of the existing annual £20,000 allowance. This will be introduced after a consultation. The same tax advantages will apply, meaning that assets within the Isa will be sheltered from capital gains and dividend taxes. VC

Read more: Isa investors given extra £5,000 for British stocks

Lower CGT rate for second home sales

Hunt also cut the higher capital gains tax (CGT) rate on residential property and said Treasury and OBR analysis suggested a lower rate of tax would increase sales and boost revenue. As it stands, higher-rate taxpayers pay 28 per cent CGT on residential property profits, but this will be cut to 24 per cent. CGT on property sales is paid on non-permanent residences such as buy-to-lets, second homes and holiday lets. Hunt said the Treasury and OBR had “discovered their inner Laffer curve”. TL

Read more: Landlord shake up as taxes cut but reliefs scrapped

NatWest stake to be sold

Jeremy Hunt confirmed that the government’s 31.85 per cent stake in NatWest (NWG) will be sold off this summer, at the earliest, via a sale to retail investors, depending on market conditions. This confirms the government’s policy outlined in the Autumn Statement.

The government bailed out what was then the Royal Bank of Scotland in 2008, and will take a loss on the sale, given the rescue price of around 500p. While the high-street banks have climbed in the past 18 months thanks to higher interest income, share prices have remained subdued compared with US banks. NatWest’s shares are down 12 per cent over the past year, and flat year-to-date.

Alcohol duty freeze extended

In a boost for pubs, Jeremy Hunt announced that the alcohol duty freeze will be extended until February 2025. The chancellor had frozen the duty in the Autumn Statement until August this year, and it would have been set to rise without action in the Budget. CA

‘Non-dom’ tax regime abolished

The non-dom tax regime, which offers certain tax advantages to people who live in the UK but who are not settled here permanently, is to be abolished and replaced with a new residency-based system in April 2025. People who move to the UK will not pay taxes on foreign income or gains for the first four years, but later be charged the same way as anyone else.

There are around 37,000 non-doms in the UK taxed on a ‘remittance basis’. UK taxes are not charged on their foreign income or capital gains unless they are remitted to the UK. Labour announced plans to scrap the non-dom rules ahead of the Budget. Hunt criticised the plans at the time but has since decided to bring forward his own version of the policy. The non-dom regime came to the fore politically for being used by Rishi Sunak’s wife, Akshata Murty. VC

Windfall tax on energy extended to 2029

The UK oil and gas sector will be frustrated by a 12-month extension to the windfall profits tax, after pushing for a full cancellation over the past year as energy prices have come down. Chancellor Jeremy Hunt said prices had remained and “so too will the sector’s windfall profits”. Profits have dropped compared with 2022 but remain above previous years.

The sunset clause to the windfall tax will now apply in 2029. The tax is 35 per cent on top of the 40 per cent corporate rate, meaning the UK is only behind Norway in terms of overall taxation. Companies reacted in 2022 by slowing investment in the North Sea, with Harbour Energy (HBR) laying off hundreds of workers and recently inking a major deal to expand into the Norwegian North Sea. Executives in the sector argue Norway’s consistent taxes make investing there more of a sure thing, even if the rate is higher.

The industry was successful in lobbying for a low-prices clause in the windfall tax, with a floor of $71.40 (£56) per barrel oil price and 54p per therm of gas. The prices have to be below these levels on average for two quarters before the tax is scrapped. “For an industry which rightfully seeks fiscal stability given the long-term nature of their investments, this makes the UK a more challenging place in which to invest,” said KPMG head of energy tax Claire Angell. AH

Holiday lettings tax relief scrapped

The furnished holiday lets (FHL) regime, which offers tax advantages to those who let out a property as a holiday home, will be abolished in April 2025. Budget documents said this would raise £600mn by 2028-29.

Hunt said this is because holiday lets reduce the availability of long-term rentals for residents. At the moment, landlords who use the furnished holiday lets regime can deduct the full cost of their mortgage interest payments from their rental income and (potentially) pay lower capital gains tax when they sell. About 127,000 properties in the UK are registered under the FHL regime. VC

NS&I to launch new British Savings Bonds

A fixed rate bond to support British companies will be launched in April 2024 via National Savings & Investments (NS&I). British Savings Bonds will offer a guaranteed interest rate for three years, increasing the savings opportunities available to consumers. VC

‘Abused’ stamp duty relief for multiple home purchases abolished

Hunt has abolished stamp duty relief for multiple home purchases, admitting it had failed to bolster the rental market.

"It was intended to support investment in the private rented sector, but an external valuation found no strong evidence that it had done so and that it was being regularly abused," he said. "So, I'm going to abolish it."

Known as multiple dwellings relief (MDR), the tax saving will be abolished from 1 June. In the policy paper accompanying the Budget, the Treasury said that deals exchanged "on or before 6 March 2024 will continue to benefit from the relief regardless of when they complete, as will any other purchases that are completed before 1 June 2024".

It added: "The government will engage with the agricultural industry to determine if there are any particular impacts for the sector that should be considered further."Lucian Cook, head of residential research at Savills, said the MDR axe combined with the CGT reduction ML

New taxes for vapes and tobacco

A new excise duty on vaping will be introduced in October 2026 to try to keep non-smokers away from e-cigarettes, amid concerns about underage users and the health impacts of the products. British American Tobacco (BATS) warned about the risks to its business from the illegal vapes flooding the market in its results last month.

However, the chancellor also announced a one-off rise in tobacco duty “to maintain a financial incentive to choose vaping over smoking”. This drove the shares of Aim-traded vaping business Supreme (SUP) up by 8 per cent. CA

Read more: The factors holding back vape-maker Supreme's share price

Hunt under fire for Canary Wharf funding

Politicians and campaigners mocked Hunt's announcement of £242mn in levelling-up funding for development in the Canary Wharf area. Hunt said this investment would deliver nearly 8,000 houses and turn the area into a hub for life science companies, adding the government is "on track to deliver over one million homes in this parliament".

Plaid Cymru's Westminster leader "congratulated" the office district in a sarcastic post on X (formerly Twitter). "Westminster's priorities are clear for all to see," she said.

Office vacancy rates in Canary Wharf have slumped since 2020 as the financial centre's multinational corporation tenants downsize amid a rise in hybrid working after Covid. Hunt also used the Budget to mention £188m already allocated to Sheffield, Blackpool and Liverpool. ML

Full expensing to be extended to leased assets

Hunt also said the government planned to extend full expensing of capital investment to leased assets “as soon as it’s affordable”. The government introduced full expensing (allowing capital investments to be deducted against taxable profits) in March last year and then made it permanent in November’s Autumn Statement, creating what Hunt described as “a £10bn tax cut for businesses”.

Draft legislation on extending the regime will be published shortly but no timeline was given for when the measure will be made permanent.

Extending full expensing to leased assets will be of particular benefit to smaller companies, said Stephen Phipson, chief executive of manufacturers’ trade body Make UK. He urged for the draft bill to be published quickly “so this measure can be made permanent at the earliest opportunity”.

The chancellor also pledged an additional £200mn of funding to extend the Recovery Loan Scheme launched to support small businesses through the Covid pandemic. It has been extended for another two years and renamed the Growth Guarantee Scheme. The threshold for registering small businesses for VAT was also lifted to £90,000, from £85,000. MF

.jpg?source=invchron&width=600)

.png?source=invchron&width=600)

.jpg?source=invchron&width=600)

.png?source=invchron&width=600)